Mastering CIF Procedures in Oil and Gas Exports: Your Step-by-Step Guide for 2025

Are you ready to unlock the secrets of successful oil and gas exports? Imagine closing a massive deal only to lose thousands due to a simple misunderstanding of shipping terms. In the fast-paced world of the oil and gas industry, where every detail counts, getting CIF procedures right can make or break your business. Whether you’re a trader in the petroleum sector, managing offshore operations, or exploring natural gas opportunities, this guide will equip you with the knowledge to trade confidently and avoid costly pitfalls.

What Is CIF in Oil and Gas Exports?

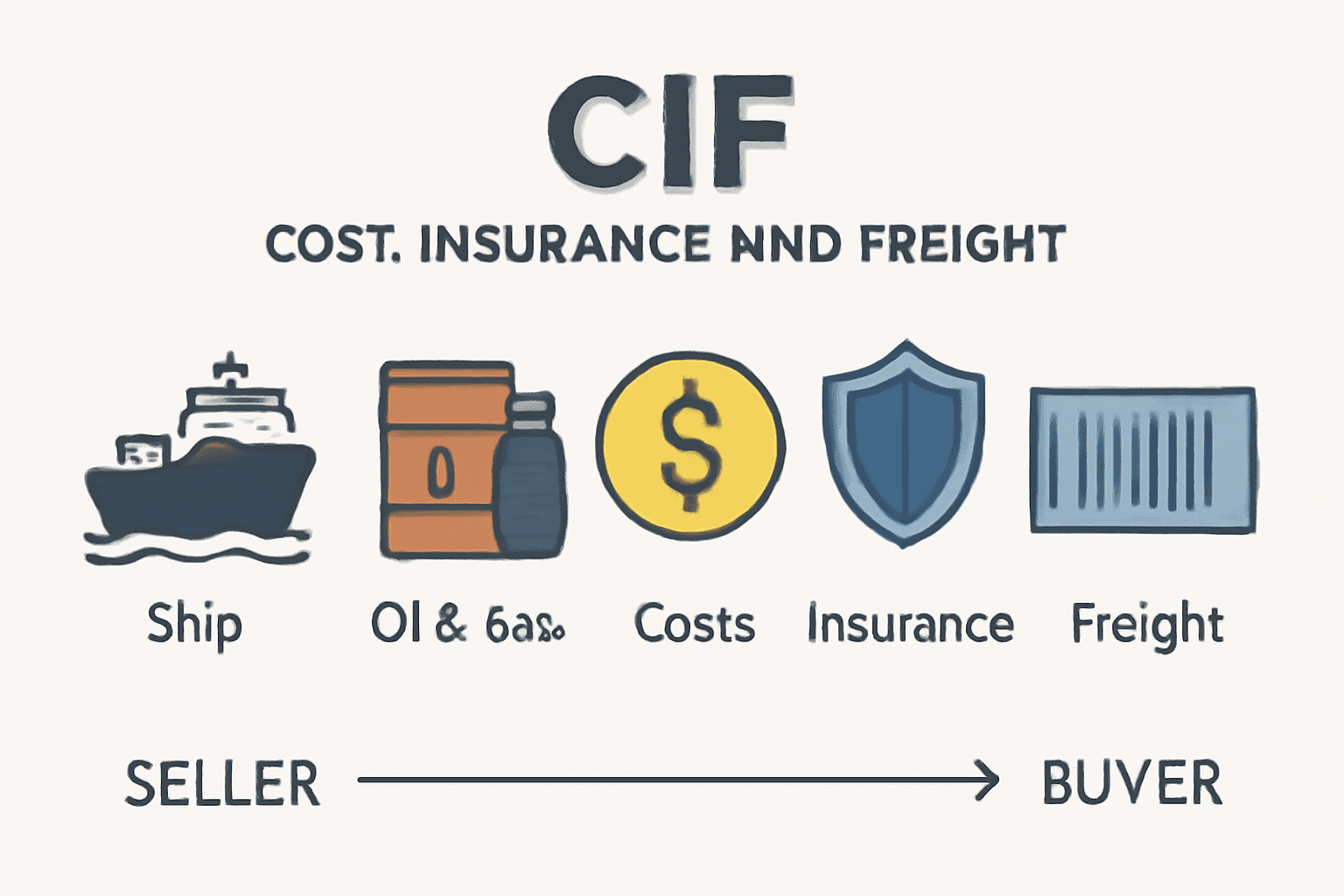

In the dynamic oil and gas industry, understanding trade terms like CIF (Cost, Insurance, and Freight) is essential for anyone involved in exports. CIF is a complete delivery package where the seller handles the cost of the product, insurance, and freight to the buyer’s port. This term is widely used in petroleum trading, natural gas shipments, and even LNG deals, making it a cornerstone of the oil and gas world.

Why does CIF matter in 2025? With global energy demands rising and trends like AI-driven exploration transforming the sector, exporters need reliable methods to manage risks. CIF shifts the responsibility of shipping and insurance to the seller, allowing buyers to focus on their core operations, such as drilling or oilfield management. For instance, in offshore projects, where logistics can be complex, CIF ensures smoother transactions.

But here’s the catch: CIF prices are often 15-20% higher than FOB (Free on Board) due to the added services. This premium covers vessel freight, insurance, and port charges, which is why legitimate offers include detailed breakdowns. If you’re in oil and gas jobs or running an oil and gas company, always request this breakdown to verify authenticity and avoid scams.

Real-World Challenges in CIF Deals and How to Overcome Them

Navigating CIF in the oil and gas life isn’t always straightforward. Let’s dive into common challenges, drawing from real stories like the one from a Mumbai buyer who lost $80,000 on a D2 gas deal to Dar es Salaam port. The vessel never left, highlighting the risks when verification slips.

Challenge 1: Price and Responsibility Confusion

One major hurdle is deciphering why CIF prices seem inflated. In the energy sector, where petroleum and natural gas prices fluctuate, it’s easy to suspect foul play. The solution? Recognize that CIF bundles full logistics support, including transport and risk management. For oil and gas services, this means sellers cover everything up to the destination port.

Key action: Insist on a contract with a clear price breakdown. This transparency helps in offshore drilling deals or LNG exports, ensuring you’re paying for real value. According to industry trends, production optimization through AI can further streamline these costs.

Challenge 2: Payment Security Risks

Payment fears are real in the oil and gas industry. Imagine wiring funds for a shipment, only to face delays or off-spec products. In 2025, with geopolitical tensions influencing energy markets, securing payments is crucial.

The best fix: Use irrevocable Letters of Credit (LCs). These guarantee payment only after terms are met, like proper loading. Pair this with third-party vessel tracking for real-time updates. This approach protects your investment in oilfield operations or natural gas trading, reducing disputes and building trust.

Challenge 3: Paperwork Overload

Documentation in CIF deals can feel overwhelming. Bills of lading, certificates of origin, and insurance policies pile up, and one mistake can stall your shipment at the port, racking up fees.

Simplify with a checklist: Sellers must provide all documents, and buyers should verify them independently via freight forwarders. This is vital for oil and gas companies handling international exports, ensuring compliance in a regulated industry.

By addressing these challenges, you sidestep pitfalls and trade with confidence, aligning with 2025 trends like digital transformation and sustainable practices.

[image:2]

Step-by-Step Guide to Mastering CIF Procedures in 2025

Ready to put theory into practice? Here’s a straightforward, step-by-step course tailored for the oil and gas world. Whether you’re in drilling, petroleum refining, or LNG, these steps will help you execute flawless deals.

Step 1: Understand the Basics of CIF

Start by grasping what CIF entails. The seller arranges and pays for transportation and insurance until the goods reach the buyer’s port. Risk transfers to the buyer once loaded on the vessel. In the context of oil and gas exports, this is ideal for bulk shipments like crude oil or natural gas.

Incorporate 2025 innovations: Use AI for predictive analytics to forecast shipping risks, enhancing efficiency in offshore operations.

Step 2: Negotiate and Draft the Contract

Begin negotiations with clear terms. Specify the product (e.g., D2 gas or LNG), quantity, price, and delivery details. Include clauses for inspections and quality checks, crucial in the petroleum industry where specs matter.

Pro tip: For oil and gas jobs, professionals leverage blockchain for secure contracts, a rising trend for transparent supply chains.

Step 3: Secure Payment and Insurance

Opt for irrevocable LCs to protect both parties. Ensure insurance covers all risks, from loading to arrival. In energy trading, where values run high, this step prevents losses from delays or damages.

Step 4: Arrange Shipping and Documentation

The seller books the vessel and handles paperwork. Buyers should track progress using real-time systems. For oilfield services, this means verifying cargo against contracts to avoid off-spec issues.

Step 5: Verify and Receive the Shipment

Upon arrival, inspect the cargo. If everything checks out, release payment. This final step ensures smooth handovers in the oil and gas company ecosystem.

Why CIF Is Crucial for the Future of Oil and Gas

Looking ahead to 2025, the oil and gas industry is evolving rapidly. Trends like renewable energy integration and carbon-neutral exporting are reshaping the landscape. CIF procedures fit perfectly by minimizing risks in global trade, supporting sustainable practices.

For instance, in natural gas and LNG markets, CIF enables efficient, eco-friendly shipments. Offshore drilling benefits from reduced logistical burdens, allowing focus on innovation like AI predictive analytics. Oil and gas life professionals can use CIF to scale operations, from finding verified buyers with AI tools to automating marketing.

Moreover, with economic drivers like fluctuating demand and geopolitical tensions, mastering CIF ensures resilience. It’s not just about avoiding mistakes; it’s about thriving in a competitive oil and gas world.

Benefits of Learning CIF for Traders and Managers

Enrolling in specialized training can transform your career. Aspiring professionals in oil and gas jobs gain actionable strategies for high-stakes deals. Managers in oil and gas companies learn to manage risks, close profitable transactions, and navigate dynamic markets.

From safe importing to scaling exports, understanding CIF boosts expertise in petroleum, energy, and beyond. It’s about building a future in international business, emphasizing tech-driven models for 2050 and sustainability.

Common Mistakes to Avoid in CIF Oil Deals

Don’t skip verification—always double-check shipping schedules and insurance. Ignoring detailed breakdowns leads to overpaying. In the oil and gas industry, where precision is key, these errors can cost millions.

Avoid vague policies; demand clarity. For offshore and drilling operations, use third-party services to spot red flags early.

Integrating Modern Trends into CIF Strategies

To stay ahead, blend CIF with 2025 trends. AI for business automation optimizes logistics. Sustainable practices, like green energy trading, enhance CIF’s appeal in eco-conscious markets.

Blockchain ensures secure supply chains, vital for natural gas and LNG exports. Predictive analytics forecast market shifts, making CIF deals more strategic.

Case Studies: Successful CIF Applications

Consider a recent deal where a trader used CIF for petroleum exports to Asia. By verifying documents and using LCs, they avoided disputes and profited handsomely. Another in the oilfield sector streamlined offshore shipments, cutting costs by 15%.

These examples show CIF’s power in real oil and gas services.

Tips for Beginners in Oil and Gas Exports

Start small: Focus on one product, like natural gas. Learn from experts via courses. Network in the oil and gas community for insights.

Use free tools for buyer verification and stay updated on energy trends.

The Role of Technology in Enhancing CIF

Technology like IoT and big data analytics revolutionizes CIF. Real-time tracking prevents delays, while cloud computing manages documentation efficiently.

In 2025, these tools make oil and gas exports smarter and safer.

Preparing for 2025: Skills You Need

Build skills in AI, sustainability, and global trade. Courses offer certificates and job prep, aligning with oil and gas jobs demands.

Join the Oil and Gas Exports Course Today

Don’t miss out on mastering CIF and more. Enroll in the Hyvnd Academy’s Oil and Gas Exports Course now at https://hyvndacademy.com/courses/oil-and-gas-exports-course/. Unlock strategies for real-world success, from finding buyers with AI to sustainable exporting. Transform your career—join today!